Missouri State Treasurer Scott Fitzpatrick recognized April as Financial Literacy Month, a month dedicated to promoting the importance of financial literacy and financial education.

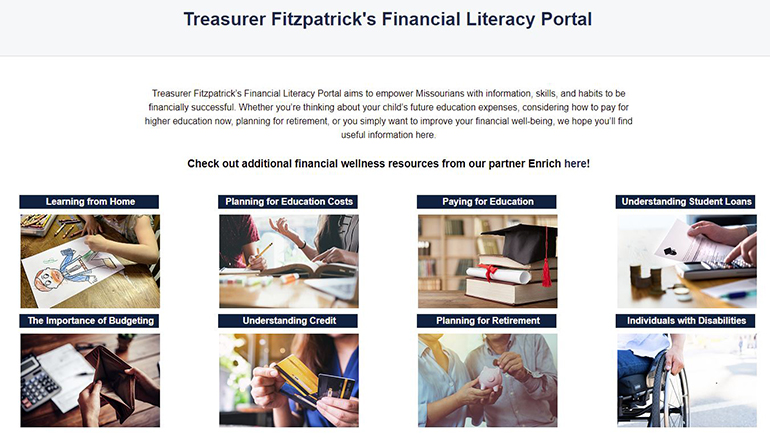

The Treasurer kicked off the month by announcing that new free resources for Missourians are now available on the Financial Literacy Portal. These engaging resources include helpful and concise articles on a variety of financial topics as well as longer, more in-depth courses. Topics include budgeting, retirement, taxes, buying a home, and more. The new Financial Wellness Initiative is made possible through a partnership with the National Association of State Treasurers and Enrich.

“Over the past two years, we’ve witnessed the pandemic impact not just our daily lives but also our finances. Despite massive economic stimulus programs being administered by the federal government, household debt is on the rise; and as a result of unprecedented federal spending, continuing inflation means household income is failing to keep up with the overall cost of living. This is why it is more important than ever to provide Missourians access to resources to help them navigate the world of personal finance and plan for their financial future,” Treasurer Fitzpatrick said. “Our Financial Literacy Portal is a great tool to do just that. I encourage all Missourians to visit and work towards their financial goals.

Additionally, in partnership with Sallie Mae and the MOST 529 team, the Treasurer’s Office will host a free webinar focused on providing information about saving for college and finding scholarship opportunities. The free virtual event will take place on Tuesday, April 19 at 6 p.m. Those who wish to participate can register here.

Missouri is leading the way when it comes to financial literacy. The Nation’s Report Card on Financial Literacy found that only five states—Missouri, Nebraska, North Carolina, Utah, and Virginia—received an A for requiring personal finance education from kindergarten through grade 12 and as a requirement for high school graduation.

The Financial Literacy Portal can be accessed here.